Baazar Style Retail IPO

About Baazar Style Retail

Looking for trendy clothes at affordable prices? Look no further than Bazaar Style Retail! This popular fashion chain has stores all over West Bengal and Odisha, making it easy to find your perfect outfit.

Why choose Bazaar Style Retail?

- Great deals: They offer amazing prices on a wide range of clothes, from casual wear to party dresses.

- Own brand clothes: Their own brand clothes are stylish and comfortable, perfect for everyday wear.

- Lots of stores: With so many stores, you’re sure to find one near you.

What makes Bazaar Style Retail special?

- Fast growth: They’ve grown really fast, especially in the last few years.

- Lots of stores: They have a ton of stores all over Eastern India.

- Own brands: They make their own clothes and stuff, which is pretty cool.

- Famous investors: Some really big names in business have invested in them.

But there’s also some stuff to think about:

- Mostly in the east: Most of their stores are in Eastern India.

- Competition is tough: There are other fashion stores trying to be the best.

- Stores are clustered: A lot of their stores are close together.

- They rely on others for delivery: They don’t have their own delivery system.

Overall, Bazaar Style Retail is a pretty big deal in Eastern India. It’s got a lot going for it, but there are also some things to watch out for.

Note: Refer to Baazar Style Retail IPO RHP for detailed information.

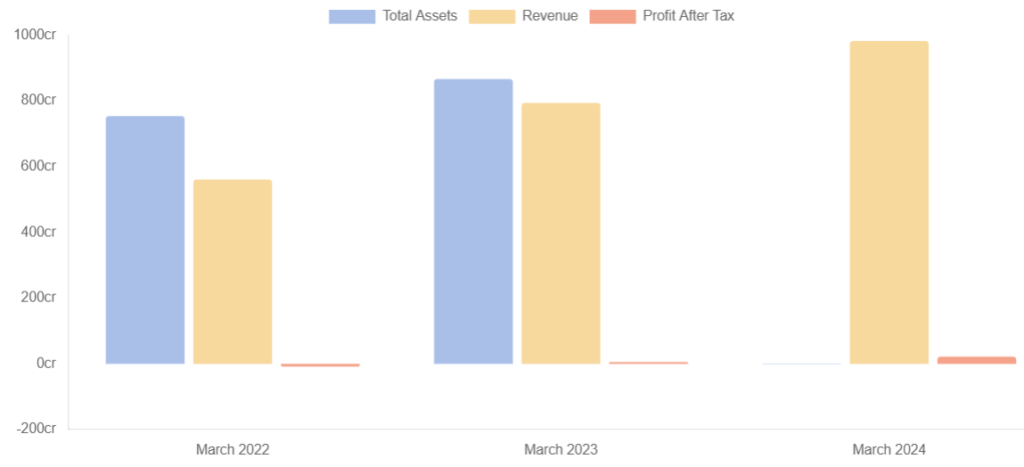

Financials of Baazar Style Retail

Baazar Style Retail IPO Details

| IPO Date | August 30, 2024 to September 3, 2024 |

| Listing Date | September 6, 2024 |

| Face Value | ₹5 per share |

| Price Band | ₹370 to ₹389 per share |

| Lot Size | 38 Shares |

| Total Issue Size | 21,456,947 shares (aggregating up to ₹834.68 Cr) |

| Fresh Issue | 3,804,627 shares (aggregating up to ₹148.00 Cr) |

| Offer for Sale | 17,652,320 shares of ₹5 (aggregating up to ₹686.68 Cr) |

| Employee Discount | Rs 35 per share |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 70,810,966 |

| Share holding post issue | 74,615,593 |

Baazar Style Retail IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 64,29,372 (29.96%) |

| QIB Shares Offered | 42,86,248 (19.97%) |

| NII (HNI) Shares Offered | 32,14,686 (14.98%) |

| bNII > ₹10L | 21,43,124 (9.99%) |

| sNII < ₹10L | 10,71,562 (4.99%) |

| Retail Shares Offered | 75,00,934 (34.95%) |

| Employee Shares Offered | 28,248 (0.13%) |

| Total Shares Offered | 2,14,59,488 (100%) |

Baazar Style Retail IPO Subscription Status Live

Baazar Style Retail IPO subscribed 40.63 times. The public issue subscribed 9.07 times in the retail category, 81.83 times in QIB, and 59.41 times in the NII category by September 3, 2024 (Day 3).

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 81.83 | 4,286,248 | 35,07,22,938 | 13,643.12 |

| Non-Institutional Buyers | 59.41 | 3,214,686 | 19,09,69,532 | 7,428.71 |

| bNII (bids above ₹10L) | 69.27 | 2,143,124 | 14,84,47,494 | 5,774.61 |

| sNII (bids below ₹10L) | 39.68 | 1,071,562 | 4,25,22,038 | 1,654.11 |

| Retail Investors | 9.07 | 7,500,934 | 6,80,50,476 | 2,647.16 |

| Employees | 35.08 | 28,248 | 9,90,812 | 38.54 |

| Total | 40.63 | 15,030,116 | 61,07,33,758 | 23,757.54 |

Baazar Style Retail IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | EMP | Total |

|---|---|---|---|---|---|

| Day 1 August 30, 2024 | 0.70 | 0.47 | 0.85 | 6.26 | 0.73 |

| Day 2 September 2, 2024 | 0.84 | 11.66 | 3.81 | 20.94 | 4.68 |

| Day 3 September 3, 2024 | 81.83 | 59.41 | 9.07 | 35.08 | 40.63 |

Baazar Style Retail IPO GMP & Listing

| IPO Name | Allotment Price | GMP | Expected Listing | Listing Price | Total Gains |

|---|---|---|---|---|---|

| Baazar Style Retail | 389 | 33 | 422 | 389 | 0% |

Post Comment