Budget 2026 Explained: Simple Breakdown for Everyone

Budget 2026 explained: It starts with understanding this budget was quite different from the last few budgets. This year, the focus was not on freebies. It was not even on tax reduction. This year, the focus was on capital expenditure. Such plans were made, which can benefit the country in the long term.

1st February is a very important day for India. Because today, our finance minister presents the Union Budget. Don’t worry, the budget is not as difficult as it seems. You just must understand some concepts. Today, our target is to make the budget so simple that even a 10-year-old child can understand it.

From this one document, we get to know 3 topics. Where is the government going to earn money? Where is the government going to spend money? And what is the government’s vision for economic growth?

Budget Like Your Family Dinner Table

You live in a joint family. In your family, your father is in charge. And Mother takes care of all the expenses. Every member of the family does one or the other profession. You all bring your salary to your mother on the first day of the month.

And then you talk during dinner about what important expenses are going to come. Younger brother says, I haven’t gone out for a long time. Let’s go to Manali. Elder brother says, I am getting married this year. Expenses are also going to be there. Father says, First see that the roof of the house is dripping.

And then Mother decides what the priorities of the house are. On which things should the house money be spent first? A country is a big family. Where all citizens contribute as taxes. And everyone’s demand is different. Everyone’s priority is different. But the government must decide what is urgent and what is not.

3 Types of Budgets Explained

There are three different types of budgets. The first is a surplus budget. Where your income is more and expenses are less. The second is a balanced budget. Where your expenses match your income. The third is a deficit budget. Where your expenses are much more than your income.

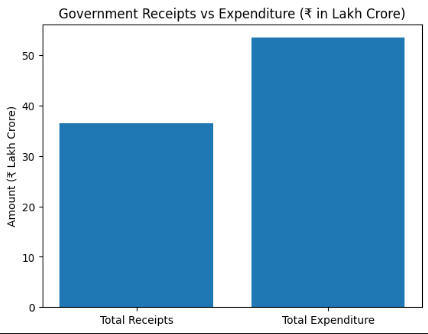

To date, our first budget has been a surplus budget. A balanced budget is not practical. At the same time, running a very big deficit budget is not in the interest of the country. Last year, our total income was 34,96,409 crores. And the total expenditure was 50,65,345 crores. The central government must borrow money so that it can fulfill all the expenses. This is called national debt.

How Budget 2026 Gets Made

The new financial year starts on April 1 and ends on March 31 next year. The budget coming in 2026 will be applied from April 1, 2026, to March 31, 2027. In September, the finance ministry releases a circular. This circular goes to every ministry, and they are asked, “What are your big projects next year?”

Then by December, all the ministries submit their requirements, called Demands for Grants. In January, the process of locking things starts. And when the budget is completely locked, Halwa is made. This is called the Halwa Ceremony. On January 29, an economic survey is released. And on February 1, the budget for the coming financial year is declared every year.

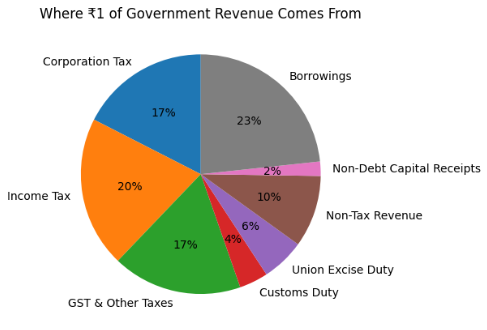

Where India’s ₹1 Rupee Comes From

If our country earns 1 rupee in a year, then where does this 1 rupee come from? Corporation tax is 18 paise. Income tax is 21 paise. GST and other taxes are 18 paise. Customs is 4 paise. Union Excise Duty is 6 paise. Non-tax revenues are 10 paise. Non-debt capital receipts are 2 paise. And even after doing this, we must borrow 24 paise.

This year, it is assumed that our total receipts will be 36,51,000 crore rupees. And total expenses will be 53,47,000 crore rupees. And the difference in this is that we must borrow that much. Which is 16,95,000 crore rupees.

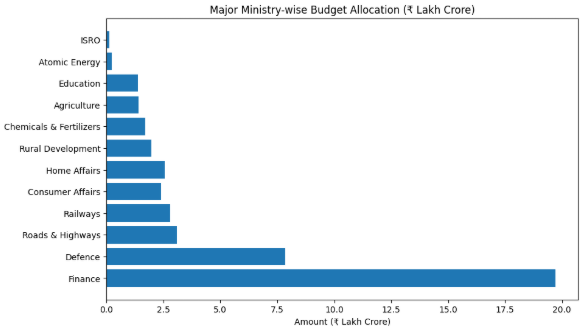

Top 10 Biggest Expenses in Budget 2026

The most money will go to the Ministry of Finance. That’s rupees 19,72,000 crores. And out of this, the interest payments are 14,03,000 crores. The Ministry of Defence has 7,84,000 crores. Out of which, defense pensions are 1,71,000 crores. And capital expenditure is rupees 2,19,000 crores.

The Ministry of Roads and Highways has received rupees 3,09,000 crores. Which will be used majorly for new construction. Railways received rupees 2,81,000 crores. Which will be spent on major capital expenses. The Ministry of Consumer Affairs and Public Distribution has received rupees 2,39,000 crores. Out of which, the MSP subsidy is rupees 2,28,000 crores.

The Ministry of Home Affairs has received rupees 2,55,000 crores. Which will be spent majorly on police forces and union territories. The Rural Development Ministry has received rupees 1,97,000 crores. Ministry of Chemicals and Fertilizers has received rupees 1,70,000 crores. Which will be spent almost entirely on fertilizer subsidy.

The Ministry of Agriculture has received rupees 1,40,000 crores. Education will be spent on rupees 1,39,000 crores. The Department of Atomic Energy has received rupees 24,000 crores. ISRO has received only 13,000 crores.

Budget 2026 explained the long-term vision.

This year’s budget focused on long-term reforms. India’s textile industry has been greatly impacted due to Trump’s tariffs. National Fiber Scheme for Self-Reliance. This will focus on both natural and man-made fibers. Rare Earth Corridor will get support. States like Andhra Pradesh, Odisha, Kerala, and Tamil Nadu will get this support.

7 high-speed rail corridors are being built. Mumbai to Pune, Pune to Hyderabad, Hyderabad to Bengaluru. Five medical tourism hubs will be developed with a private partnership. A program to train tourist guides is going to be made with the help of IIM. In North India, NIMHANS 2 will be established.

From family budgets to India’s ₹53 lakh crore spending plan, Budget 2026 bets big on infrastructure over freebies. Will execution match the vision or stay stuck in ministry priorities? Share your take below-capital or revenue expense?

Share this content:

Post Comment