Shree Tirupati Balajee Agro Trading Company IPO

About Shree Tirupati Balajee IPO

Shree Tirupati Balajee is a company that makes and sells big, flexible bags called FIBCs. These bags are used to store and transport things like chemicals, food, and waste. The company has been around since 2001 and has factories in India.

Why is Shree Tirupati Balajee a good company?

- Custom-made bags: The company can make bags to fit the needs of different customers.

- Lightweight and affordable: The bags are light and don’t cost a lot to use, which saves money on shipping.

- Many different kinds of bags: The company offers a wide variety of bags for different uses.

- Factories in good locations: The company’s factories are located in places that make it easy to produce and ship the bags.

What are the risks for Shree Tirupati Balajee?

- Unsecured loans: The company has borrowed money that it doesn’t have to pay back right away. If the lenders ask for the money back, it could be difficult for the company to pay it.

- All factories are in one place: If something bad happens in the area where the factories are, it could affect the company’s business.

- Government rules about plastic: There might be new rules about using plastic, which could make it harder for the company to do business.

- Price of materials: The price of the materials used to make the bags can go up and down, which can affect the company’s profits.

Note: Refer to Shree Tirupati Balajee IPO RHP for detailed information.

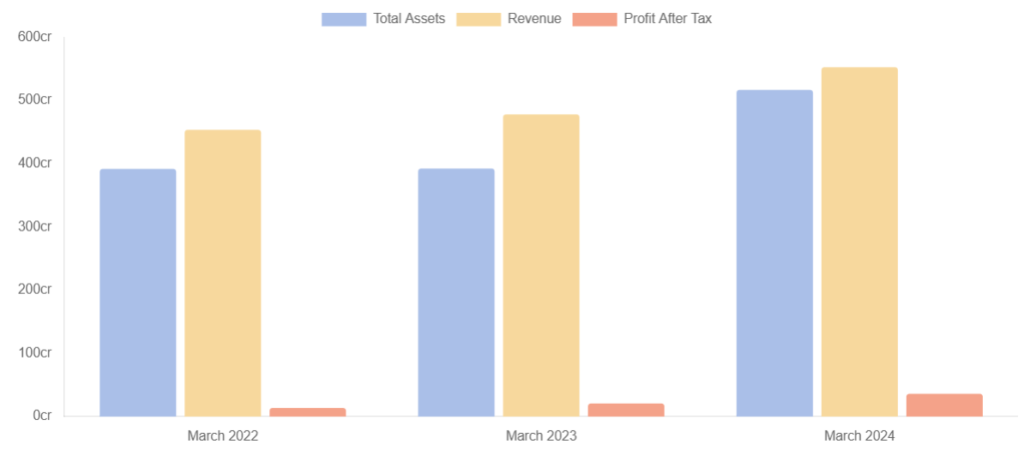

Financials of Shree Tirupati Balajee

Shree Tirupati Balajee IPO Details

| IPO Date | September 5, 2024 to September 9, 2024 |

| Listing Date | September 12, 2024 |

| Face Value | ₹10 per share |

| Price Band | ₹78 to ₹83 per share |

| Lot Size | 180 Shares |

| Total Issue Size | 20,440,000 shares (aggregating up to ₹169.65 Cr) |

| Fresh Issue | 14,750,000 shares (aggregating up to ₹122.43 Cr) |

| Offer for Sale | 5,690,000 shares of ₹10 (aggregating up to ₹47.23 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 66,820,852 |

| Share holding post issue | 81,570,852 |

Shree Tirupati Balajee IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 61,32,000 (30%) |

| QIB Shares Offered | 40,88,000 (20%) |

| NII (HNI) Shares Offered | 30,66,000 (15%) |

| bNII > ₹10L | 20,44,000 (10%) |

| sNII < ₹10L | 10,22,000 (5%) |

| Retail Shares Offered | 71,54,000 (35%) |

| Total Shares Offered | 2,04,40,000 (100%) |

Shree Tirupati Balajee IPO Subscription Status

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 150.87 | 4,088,000 | 61,67,76,120 | 5,119.24 |

| Non-Institutional Buyers | 210.12 | 3,066,000 | 64,42,22,340 | 5,347.05 |

| bNII (bids above ₹10L) | 225.47 | 2,044,000 | 46,08,65,340 | 3,825.18 |

| sNII (bids below ₹10L) | 179.41 | 1,022,000 | 18,33,57,000 | 1,521.86 |

| Retail Investors | 73.22 | 7,154,000 | 52,38,28,620 | 4,347.78 |

| Total | 124.74 | 14,308,000 | 1,78,48,27,080 | 14,814.06 |

Shree Tirupati Balajee IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Day 1 September 5, 2024 | 4.46 | 5.29 | 8.24 | 6.53 |

| Day 2 September 6, 2024 | 4.69 | 28.64 | 21.73 | 18.34 |

| Day 3 September 9, 2024 | 150.87 | 210.12 | 73.22 | 124.74 |

Shree Tirupati Balajee IPO GMP & Listing

| IPO Name | Allotment Price | GMP | Expected Listing | Listing Price | Total Gains |

|---|---|---|---|---|---|

| Shree Tirupati Balajee | 83 | 27 | 110 | 90 | 8.43% |

5 comments