Tolins Tyres IPO

About Tolins Tyres IPO

What does Tolins Tyres do?

Tolins Tyres is a company that makes tyres for different kinds of vehicles, including trucks, farm equipment, and motorcycles. They also make other tyre-related products. The company has factories in India and the United Arab Emirates.

Why is Tolins Tyres a good company?

- Good location: The factories in India are close to a port and an airport, which makes it easy to ship the tyres.

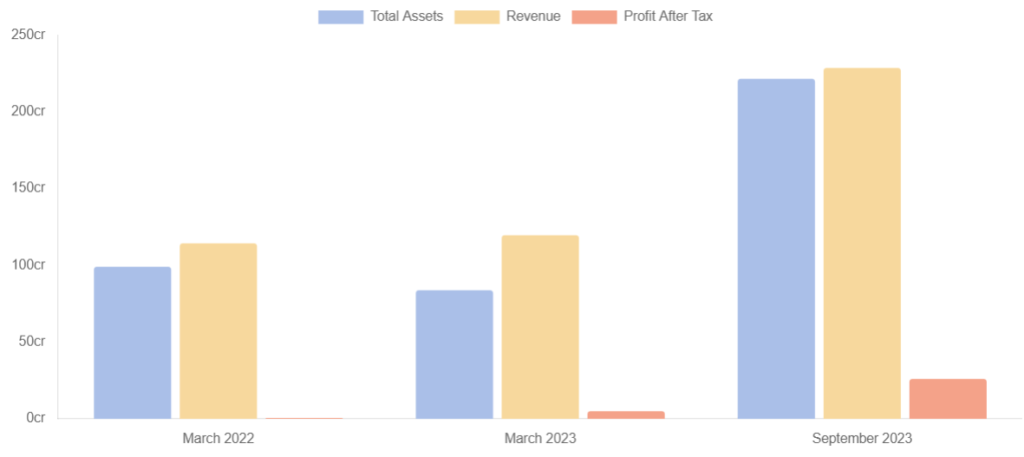

- Growing profits: The company has been making more money each year.

- Many different products: Tolins Tyres offers a wide variety of tyres and other products.

- Quality certifications: The company has been recognized for its quality standards.

What are the risks for Tolins Tyres?

- Most sales are in one region: Most of the company’s sales are in Kerala, India. If something bad happens in that area, it could hurt the business.

- Competition: There are other companies that also make tyres, so Tolins Tyres has to compete with them.

- High costs: The company spends a lot of money on materials and labor.

- Dependence on contract workers: The company uses a lot of contract workers, which could be a problem if they are not available or if their wages change.

Note: Refer to Tolins Tyres IPO RHP for detailed information.

Financials of Tolins Tyres

Tolins Tyres IPO Details

| IPO Date | September 9, 2024 to September 11, 2024 |

| Listing Date | September 16, 2024 |

| Face Value | ₹5 per share |

| Price Band | ₹215 to ₹226 per share |

| Lot Size | 66 Shares |

| Total Issue Size | 10,176,992 shares (aggregating up to ₹230.00 Cr) |

| Fresh Issue | 8,849,558 shares (aggregating up to ₹200.00 Cr) |

| Offer for Sale | 1,327,434 shares of ₹5 (aggregating up to ₹30.00 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 30,659,272 |

| Share holding post issue | 39,508,830 |

Tolins Tyres IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 30,53,097 (30%) |

| QIB Shares Offered | 20,35,398 (20%) |

| NII (HNI) Shares Offered | 15,26,549 (15%) |

| bNII > ₹10L | 10,17,699 (10%) |

| sNII < ₹10L | 5,08,850 (5%) |

| Retail Shares Offered | 35,61,947 (35%) |

| Total Shares Offered | 1,01,76,991 (100%) |

Tolins Tyres IPO Subscription Status

Tolins Tyres IPO subscribed 25.03 times. The public issue subscribed 22.45 times in the retail category, 26.72 times in QIB, and 28.80 times in the NII category by September 11, 2024 (Day 3).

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 26.72 | 2,035,398 | 5,43,83,274 | 1,229.06 |

| Non-Institutional Buyers | 28.80 | 1,526,549 | 4,39,71,774 | 993.76 |

| bNII (bids above ₹10L) | 26.39 | 1,017,699 | 2,68,58,634 | 607.01 |

| sNII (bids below ₹10L) | 33.63 | 508,850 | 1,71,13,140 | 386.76 |

| Retail Investors | 22.45 | 3,561,947 | 7,99,83,420 | 1,807.63 |

| Total | 25.03 | 7,123,894 | 17,83,38,468 | 4,030.45 |

Tolins Tyres IPO IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Day 1 September 9, 2024 | 0.13 | 0.88 | 3.41 | 1.93 |

| Day 2 September 10, 2024 | 0.48 | 4.32 | 8.98 | 5.56 |

| Day 3 September 11, 2024 | 26.72 | 28.80 | 22.45 | 25.03 |

Tolins Tyres IPO GMP & Listing

| IPO Name | Allotment Price | GMP | Expected Listing | Listing Price | Total Gains |

|---|---|---|---|---|---|

| Tolins Tyres | 226 | 30 | 256 | 228 | 0.88% |

Post Comment