ECO Mobility IPO Details

About ECO Mobility

ECO Mobility was founded in 1996 and has been offering employee transportation services (ETS) and chauffeured car rentals (CCR) to business clients in IT, BPO, consulting, healthcare, e-commerce, and manufacturing. These clients include Fortune 500 companies in India. For over 25 years, the company has operated a fleet of over 12,000 vehicles, ranging from economy to luxury cars, minivans, and luxury coaches. Among other Indian firms, it supplied CCR and ETS to 60 BSE 500 companies and 42 Fortune 500 organizations in Fiscal 2024.

By using its own cars and suppliers, the firm established a pan-Indian presence in 109 cities as of March 31, 2024, including 21 states and 4 union territories in India. It uses suppliers to run its operations in 97 Indian cities. More than 1,100 Indian organizations’ CCR and ETS standards were met by the firm in Fiscal 2024. Through the CCR and ETS sectors, the firm accomplished over 3,100,000 journeys in Fiscal 2024, with an average of over 8,400 travels per day. Indigo, HCL Corporation, Safexpress, Deloitte Consulting India, Urban Company), IndusInd Bank, HDFC Life Insurance, Walmart Global Tech, and other companies are among its clients.

Note: Refer to ECO Mobility IPO RHP for detailed information.

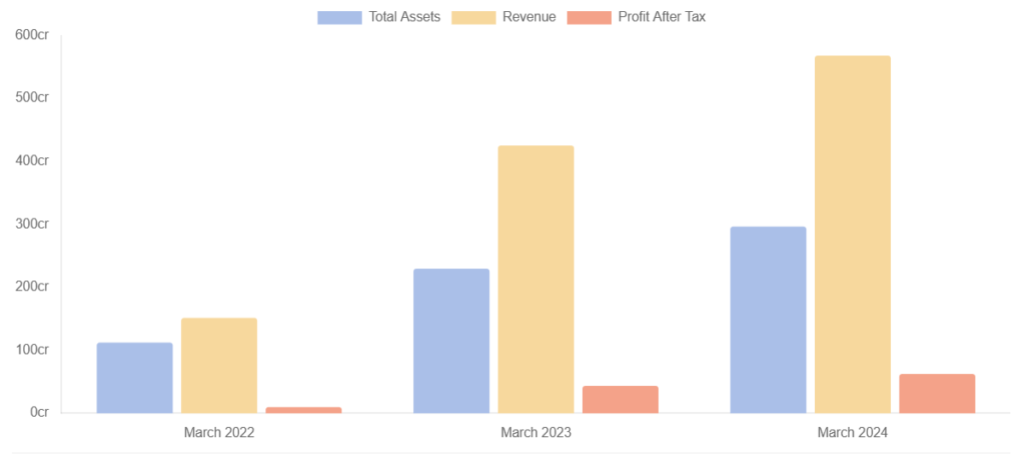

Financials of ECO Mobility

ECO Mobility IPO Details

| IPO Date | August 28, 2024 to August 30, 2024 |

| Listing Date | September 4, 2024 |

| Face Value | ₹2 per share |

| Price Band | ₹318 to ₹334 per share |

| Lot Size | 44 Shares |

| Total Issue Size | 18,000,000 shares (aggregating up to ₹601.20 Cr) |

| Offer for Sale | 18,000,000 shares of ₹2 (aggregating up to ₹601.20 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 60,000,000 |

| Share holding post issue | 60,000,000 |

ECO Mobility IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 54,00,000 (30%) |

| QIB Shares Offered | 36,00,000 (20%) |

| NII (HNI) Shares Offered | 27,00,000 (15%) |

| bNII > ₹10L | 18,00,000 (10%) |

| sNII < ₹10L | 9,00,000 (5%) |

| Retail Shares Offered | 63,00,000 (35%) |

| Total Shares Offered | 1,80,00,000 (100%) |

ECO Mobility IPO Subscription Status

ECO Mobility IPO subscribed 64.18 times. The public issue subscribed 19.66 times in the retail category, 136.85 times in QIB, and 71.17 times in the NII category by August 30, 2024 (Day 3).

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 136.85 | 3,600,000 | 49,26,74,468 | 16,455.33 |

| Non-Institutional Buyers | 71.17 | 2,700,000 | 19,21,49,980 | 6,417.81 |

| bNII (bids above ₹10L) | 74.66 | 1,800,000 | 13,43,82,380 | 4,488.37 |

| sNII (bids below ₹10L) | 64.19 | 900,000 | 5,77,67,600 | 1,929.44 |

| Retail Investors | 19.66 | 6,300,000 | 12,38,65,808 | 4,137.12 |

| Employees | [.] | 0 | 0 | 0 |

| Others | [.] | 0 | 0 | 0 |

| Total | 64.18 | 12,600,000 | 80,86,90,256 | 27,010.25 |

ECO Mobility IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Day 1 August 28, 2024 | 0.04 | 6.70 | 3.93 | 3.41 |

| Day 2 August 29, 2024 | 0.10 | 23.53 | 9.14 | 9.64 |

| Day 3 August 30, 2024 | 136.85 | 71.17 | 19.66 | 64.18 |

ECO Mobility IPO GMP

On April 9, 2024, ECOS (India) Mobility went public on the stock market. The IPO has 64.18x subscriptions. On September 4, 2024, at 10:27 AM, the ECOS (India) Mobility IPO’s most recent GMP was ₹126. The projected profit/loss for the IPO was 37.72%, according to the most recent GMP.

ECO Mobility IPO Listing

The ECOS (India) Mobility IPO (ECOSMOBLTY,544239) had an issue price of ₹334,00 and was listed at ₹390.00, a 16.77% premium above the allotted price.

Post Comment