Premier Energies IPO Details

About Premier Energies

Premier Energies, a leading solar energy solutions provider, has successfully concluded its Initial Public Offering (IPO) and is now listed on the Bombay Stock Exchange (BSE) and National Stock Exchange (NSE).

Company Overview

Established in 1995, Premier Energies has a strong track record of 29 years in the solar industry. The company’s core business operations include:

- Manufacturing of solar PV cells and modules

- EPC services for various solar power projects

- O&M services for executed projects

- Independent power production

Key Highlights

- Diverse Product Range: Premier Energies offers a wide range of solar products and services, catering to various customer needs.

- Strong Experience: The company’s 29 years of experience in the solar industry position it as a reliable player in the market.

- Successful IPO: The IPO was well-received by investors, indicating strong confidence in the company’s future prospects.

Note: Refer to Premier Energies IPO RHP for detailed information.

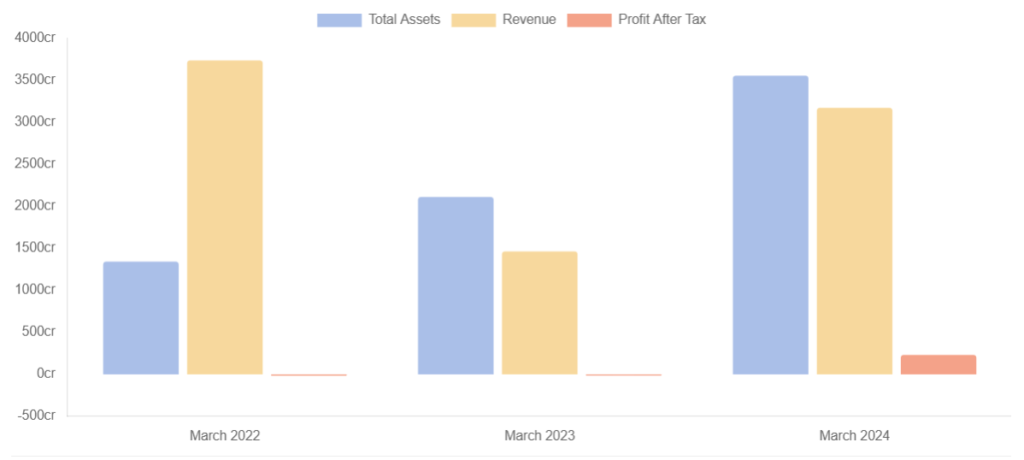

Financials of Premier Energies

Premier Energies IPO Details

| IPO Date | August 27, 2024 to August 29, 2024 |

| Listing Date | September 3, 2024 |

| Face Value | ₹1 per share |

| Price Band | ₹427 to ₹450 per share |

| Lot Size | 33 Shares |

| Total Issue Size | 62,897,777 shares (aggregating up to ₹2,830.40 Cr) |

| Fresh Issue | 28,697,777 shares (aggregating up to ₹1,291.40 Cr) |

| Offer for Sale | 34,200,000 shares of ₹1 (aggregating up to ₹1,539.00 Cr) |

| Employee Discount | Rs 22 per share |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 422,065,168 |

| Share holding post issue | 450,762,945 |

Premier Energies IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 1,88,02,666 (29.89%) |

| QIB Shares Offered | 1,25,35,111 (19.93%) |

| NII (HNI) Shares Offered | 94,01,333 (14.94%) |

| bNII > ₹10L | 62,67,555 (9.96%) |

| sNII < ₹10L | 31,33,778 (4.98%) |

| Retail Shares Offered | 2,19,36,444 (34.87%) |

| Employee Shares Offered | 2,33,644 (0.37%) |

| Total Shares Offered | 6,29,09,199 (100%) |

Premier Energies IPO Subscription Status Live

Premier Energies IPO subscribed 75.00 times. The public issue subscribed 7.44 times in the retail category, 212.42 times in QIB, and 50.98 times in the NII category by August 29, 2024 (Day 3).

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 212.42 | 12,535,111 | 2,66,27,11,491 | 1,19,822.02 |

| Non-Institutional Buyers | 50.98 | 9,401,333 | 47,93,11,569 | 21,569.02 |

| bNII (bids above ₹10L) | 58.00 | 6,267,555 | 36,34,93,053 | 16,357.19 |

| sNII (bids below ₹10L) | 36.96 | 3,133,778 | 11,58,18,516 | 5,211.83 |

| Retail Investors | 7.44 | 21,936,444 | 16,32,27,669 | 7,345.25 |

| Employees | 11.32 | 233,644 | 26,44,191 | 118.99 |

| Others | [.] | 0 | 0 | 0 |

| Total | 75.00 | 44,106,533 | 3,30,78,94,920 | 1,48,855.27 |

Premier Energies IPO Subscription Details Day Wise

| Date | QIB | NII | Retail | EMP | Total |

|---|---|---|---|---|---|

| Day 1 August 27, 2024 | 0.04 | 5.53 | 1.91 | 0.00 | 2.16 |

| Day 2 August 28, 2024 | 1.37 | 19.35 | 4.37 | 7.11 | 6.72 |

| Day 3 August 29, 2024 | 212.42 | 50.98 | 7.44 | 11.32 | 75.00 |

Premier Energies IPO GMP

Premier Energies began trading on the stock market on September 3, 2024. The IPO was 75.00 times oversubscribed. Premier Energies IPO’s latest GMP was ₹487, as of Sep 3rd, 2024 10:26 AM. According to the most recent GMP, the estimated profit/loss for the IPO was 108.22%.

Premier Energies IPO Listing

Premier Energies IPO (PREMIERENE,544238) had an issue price of ₹450.00 and was listed for ₹990.00, indicating a 120.00% increase over the allotted price.

Post Comment