Swiggy IPO

About Swiggy IPO

What does Swiggy do?

Swiggy, founded in 2014, has risen to become one of India’s largest food and grocery delivery companies. It offers its users a simple platform from which they can search, choose, order, and pay for food (Food Delivery), groceries, and household products (Instamart), as well as have orders delivered to their homes via an on-demand delivery partner network. Swiggy plans to go even further as it prepares for its IPO, focusing on rapid commerce with Instamart. Swiggy has a competitive advantage over Zepto and Zomato-backed Blinkit due to its scale and market presence. The IPO will help to enhance its market position and fund some of its growth.

Key Business Areas:

- Food Delivery: The primary business of delivering food from restaurants.

- Instamart: It is a quick commerce service that delivers groceries and household supplies on demand.

- Out-of-Home Consumption: Enables restaurant reservations and event bookings.

- Supply chain and distribution: It include B2B deliveries, warehousing, and logistics.

- Platform innovation: It includes new initiatives such as Swiggy Genie (pick-up and drop) and Swiggy Minis (hyperlocal commerce).

Strengths:

- Significant market presence and brand familiarity.

- Beyond meal delivery, there are more diverse offerings.

- A large network of delivery partners.

- Efficient operations and technologically based solutions.

- Concentrate on client experience and ease.

Risks:

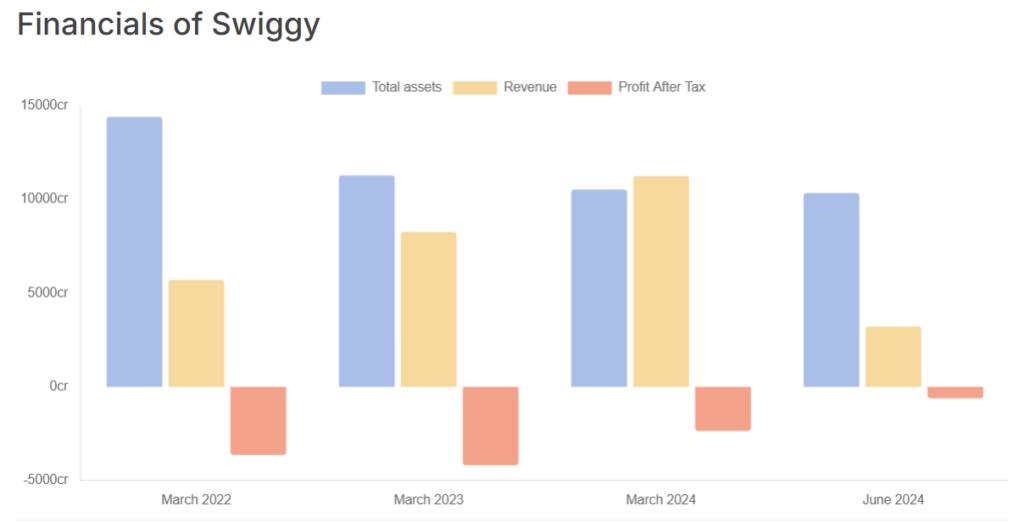

- Consistent net losses and negative cash flows.

- Relying on user acquisition and retention.

- Dependence on restaurant and vendor partners.

- Instamart effectively manages its dark stores.

- Potential regulatory changes affecting the business.

All things considered, Swiggy is a major force in the Indian grocery and food delivery industry. It has a lot of room to grow, particularly in the fast commerce market. To maintain its success, it must, however, overcome its profitability issues and negotiate a competitive environment.

Note: Refer to Swiggy IPO RHP for detailed information.

Swiggy IPO Details

| IPO Date | November 6, 2024 to November 8, 2024 |

| Listing Date | November 13, 2024 |

| Face Value | ₹1 per share |

| Price Band | ₹371 to ₹390 per share |

| Lot Size | 38 Shares |

| Total Issue Size | 290,446,837 shares (aggregating up to ₹11,327.43 Cr) |

| Fresh Issue | 115,358,974 shares (aggregating up to ₹4,499.00 Cr) |

| Offer for Sale | 175,087,863 shares of ₹1 (aggregating up to ₹6,828.43 Cr) |

| Employee Discount | Rs 25 per share |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 2,123,066,748 |

| Share holding post issue | 2,238,425,722 |

Swiggy IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 13,03,85,211 (44.88%) |

| QIB Shares Offered | 8,69,23,475 (29.92%) |

| NII (HNI) Shares Offered | 4,34,61,737 (14.96%) |

| bNII > ₹10L | 2,89,74,491 (9.97%) |

| sNII < ₹10L | 1,44,87,246 (4.99%) |

| Retail Shares Offered | 2,89,74,491 (9.97%) |

| Employee Shares Offered | 7,50,000 (0.26%) |

| Total Shares Offered | 2,04,40,000 (100%) |

Swiggy IPO Subscription Status

| Investor Category | Subscription (times) | Shares Offered* | Shares bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 6.02 | 86,923,475 | 52,30,89,494 | 20,400.49 |

| Non-Institutional Buyers | 0.41 | 43,461,737 | 27,79,168 | 698.19 |

| bNII (bids above ₹10L) | 0.37 | 28,974,491 | 1,07,03,612 | 417.44 |

| sNII (bids below ₹10L) | 0.50 | 14,487,246 | 71,98,606 | 280.75 |

| Retail Investors | 1.14 | 28,974,491 | 3,30,77,746 | 1,290.03 |

| Employees | 1.65 | 750,000 | 12,37,546 | 48.26 |

| Total | 3.59 | 160,109,703 | 57,53,07,004 | 22,436.97 |

Swiggy IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | EMP | Total |

|---|---|---|---|---|---|

| Day 1 November 6, 2024 | 0.00 | 0.06 | 0.56 | 0.76 | 0.12 |

| Day 2 November 7, 2024 | 0.28 | 0.14 | 0.84 | 1.16 | 0.35 |

| Day 3 November 8, 2024 | 6.02 | 0.41 | 1.14 | 1.65 | 3.59 |

Swiggy IPO GMP & Listing

| IPO Name | Allotment Price | GMP | Expected Listing | Listing Price | Total Gains |

|---|---|---|---|---|---|

| Swiggy | 390 | 0 | 390 | – | – |

Post Comment