Western Carriers (India) IPO

About Western Carriers (India) IPO

What does Western Carriers (India) do?

Western Carriers is a company that helps other businesses move things from one place to another. They use different methods like trucks, trains, ships, and airplanes. They work with companies in many industries, including metals, food, medicine, chemicals, and energy.

Why is Western Carriers a good company?

- Custom solutions: The company can design a plan to fit the specific needs of each customer.

- Different ways to move things: Western Carriers can use a variety of methods to transport goods, which can save time and money.

- Long-term customers: Many companies have been using Western Carriers for a long time, which shows that they are reliable.

- Flexible business: The company is able to change and grow quickly.

- Good timing: The company is in a good position to benefit from the growing Indian logistics market.

What are the risks for Western Carriers?

- Dependence on a few big customers: Most of the company’s business comes from a small number of large customers. If these customers stop using Western Carriers, it could hurt the company.

- Problems with infrastructure: The company relies on roads, ports, and other infrastructure to move goods. If there are problems with this infrastructure, it could affect the company’s business.

- Need for money: The company needs a lot of money to operate. If customers are late in paying or if the company has to pay suppliers more quickly, it could have financial problems.

- Unsecured loans: The company has borrowed money that doesn’t have to be paid back right away. If the lenders ask for the money back, it could be difficult for the company to pay it.

- Technology risks: The company uses a lot of technology to run its business. If there are problems with the technology, it could lead to financial losses or damage the company’s reputation.

Note: Refer to Western Carriers (India) IPO RHP for detailed information.

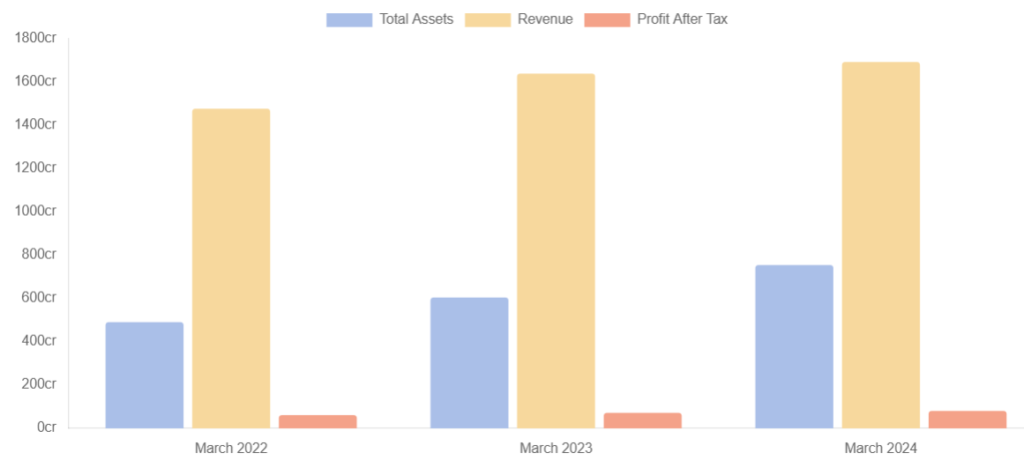

Financials of Western Carriers (India) IPO

Western Carriers (India) IPO Details

| IPO Date | September 13, 2024 to September 19, 2024 |

| Listing Date | September 24, 2024 |

| Face Value | ₹5 per share |

| Price Band | ₹163 to ₹172 per share |

| Lot Size | 87 Shares |

| Total Issue Size | 28,655,813 shares (aggregating up to ₹492.88 Cr) |

| Fresh Issue | 23,255,813 shares (aggregating up to ₹400.00 Cr) |

| Offer for Sale | 5,400,000 shares of ₹5 (aggregating up to ₹92.88 Cr) |

| Issue Type | Book Built Issue IPO |

| Listing At | BSE, NSE |

| Share holding pre issue | 78,699,400 |

| Share holding post issue | 101,955,213 |

Western Carriers (India) IPO Reservation

| Investor Category | Shares Offered |

|---|---|

| Anchor Investor Shares Offered | 85,96,743 (30%) |

| QIB Shares Offered | 57,31,163 (20%) |

| NII (HNI) Shares Offered | 42,98,372 (15%) |

| bNII > ₹10L | 28,65,581 (10%) |

| sNII < ₹10L | 14,32,791 (5%) |

| Retail Shares Offered | 1,00,29,535 (35%) |

| Total Shares Offered | 2,86,55,813 (100%) |

Western Carriers (India) IPO Subscription Status

Western Carriers (India) IPO subscribed 31.69 times. The public issue subscribed 26.92 times in the retail category, 28.81 times in QIB, and 46.68 times in the NII category by September 19, 2024 (Day 5).

| Investor Category | Subscription (times) | Shares Offered | Shares Bid for | Total Amount (Rs Cr.)* |

|---|---|---|---|---|

| Qualified Institutions | 28.81 | 5,731,163 | 16,50,92,679 | 2,839.59 |

| Non-Institutional Buyers | 46.68 | 4,298,372 | 20,06,27,307 | 3,450.79 |

| bNII (bids above ₹10L) | 41.65 | 2,865,581 | 11,93,45,817 | 2,052.75 |

| sNII (bids below ₹10L) | 56.73 | 1,432,791 | 8,12,81,490 | 1,398.04 |

| Retail Investors | 26.92 | 10,029,535 | 26,99,92,668 | 4,643.87 |

| Total | 31.69 | 20,059,070 | 63,57,12,654 | 10,934.26 |

Western Carriers (India) IPO Subscription Details Day-wise

| Date | QIB | NII | Retail | Total |

|---|---|---|---|---|

| Day 1 September 13, 2024 | 0.00 | 0.40 | 1.54 | 0.85 |

| Day 2 September 16, 2024 | 0.03 | 5.62 | 7.84 | 5.13 |

| Day 3 September 17, 2024 | 0.10 | 13.33 | 13.97 | 9.87 |

| Day 4 September 18, 2024 | 0.14 | 21.91 | 19.69 | 14.58 |

| Day 5 September 19, 2024 | 28.81 | 46.68 | 26.92 | 31.69 |

Western Carriers (India) IPO GMP & Listing

| IPO Name | Allotment Price | GMP | Expected Listing | Listing Price | Total Gains |

|---|---|---|---|---|---|

| Western Carriers (India) | 172 | 10 | 182 | will list on 24 Sep | will list on 24 Sep |

Post Comment