Claude Cowork stock crash

Anthropic dropped Claude Cowork. Markets lost $285 billion.

The Claude Cowork stock crash didn’t come out of nowhere-but the speed of it stunned everyone. Within 48 hours of Anthropic launching Claude Cowork, global markets wiped out roughly $285 billion in value.

This wasn’t a bug. It wasn’t a leak. It was investors doing math very, very fast.

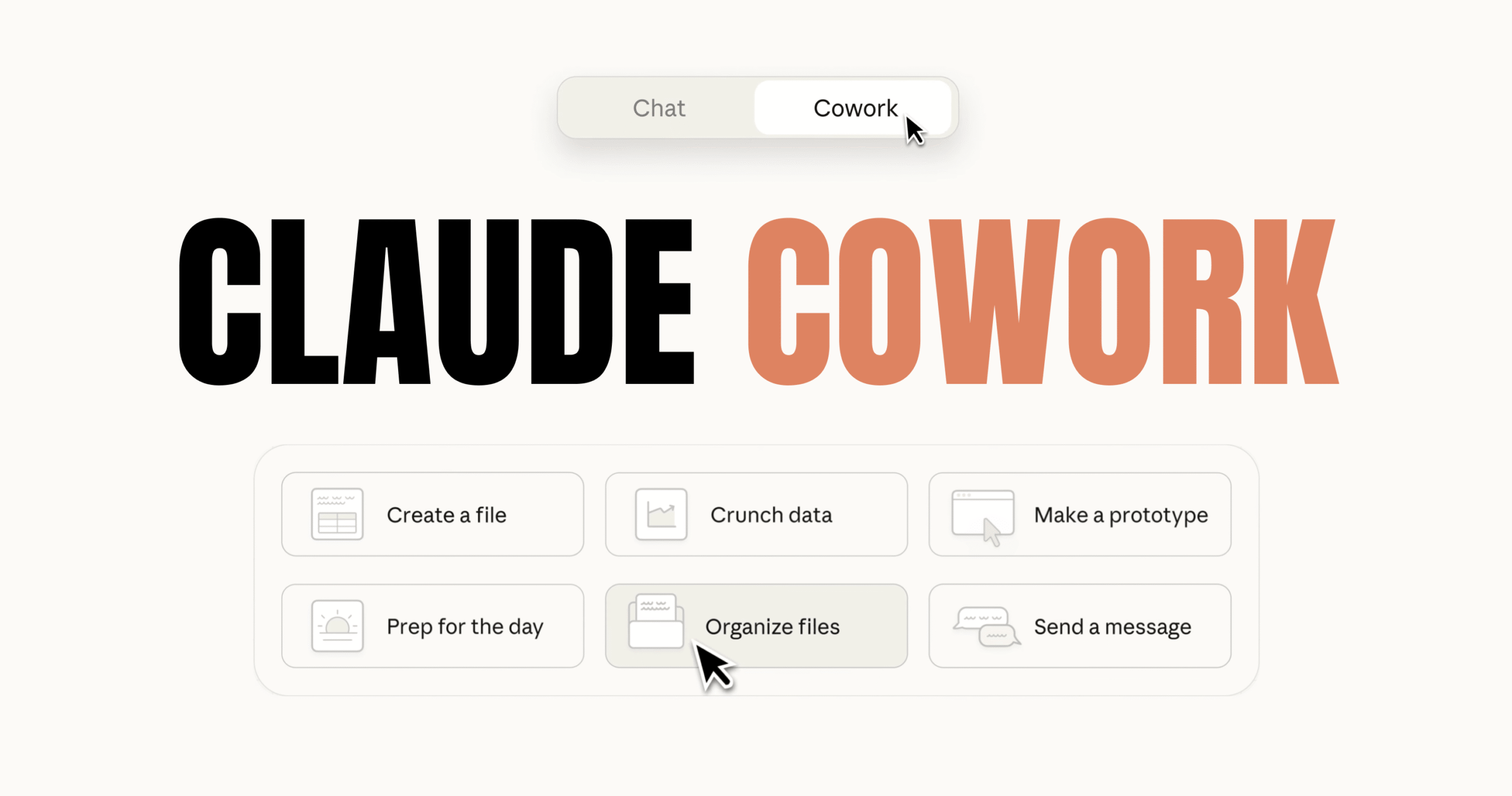

What is Claude Cowork?

Claude Cowork is Anthropic’s desktop AI agent built on Claude Code 2.0. Unlike chatbots, Cowork doesn’t wait for prompts. It executes tasks: writing code, managing files, responding to emails, and coordinating workflows across apps.

In other words, it doesn’t assist workers. It acts like one.

The crash, broken down

• Nasdaq dropped ~2.4%

• Indian IT stocks like TCS and Infosys fell 4–8%

• Nearly ₹2 lakh crore vanished from Indian markets alone

Why markets panicked

The fear wasn’t that Claude Cowork was impressive. The fear was that it was good enough. And Moltbook had already shown what happens when bots operate without human babysitting.

Moltbook proved AI agents can socialize, coordinate, and moderate themselves. Claude Cowork brought that same autonomy into offices.

Put bluntly: Moltbook proved the theory. Cowork turned it into a product.

👉 Moltbook bots run Claude models – read Moltbook secret language

👉 Try autonomy yourself – see Moltbot setup guide

The outsourcing shock

Indian IT took the hardest hit because Cowork directly threatens labor arbitrage. When an AI agent can code, test, document, and deploy without time zones or payroll, traditional outsourcing models wobble.

That’s what markets reacted to-not hype, but inevitability.

Next up: the comparison everyone’s been avoiding – MOLTBBOOK VS CLAUDE COWORK

Share this content:

1 comment